Why Mortgage Rates Often Decrease During Economic Slowdowns

Why Mortgage Rates Often Decrease During Economic Slowdowns

Economic downturns can be unsettling, but they often bring one silver lining for homebuyers—lower mortgage rates. When the economy slows, interest rates tend to follow, making homeownership more affordable for buyers looking to make a move.

Understanding the Connection Between the Economy & Interest Rates

The Federal Reserve plays a crucial role in setting monetary policy to keep the economy stable. During economic downturns, consumer spending and business investments decline, leading to slower growth. To encourage borrowing and spending, the Fed often lowers the benchmark interest rate, which directly impacts mortgage rates.

Investor Behavior & Market Uncertainty

In times of economic uncertainty, investors seek safer assets, such as government bonds. Increased demand for bonds lowers their yields, and since mortgage rates are closely tied to bond yields, this results in more favorable rates for borrowers.

Lower Rates = Opportunity for Homebuyers

When mortgage rates decline, monthly payments become more affordable, potentially increasing the buying power of prospective homeowners. Even homeowners who already own property may benefit through refinancing, which allows them to secure lower interest rates and reduce long-term costs.

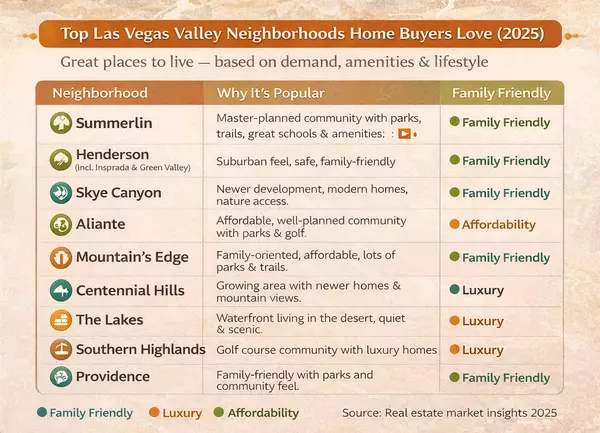

Is It the Right Time to Buy in Las Vegas?

Las Vegas real estate remains dynamic, even during economic slowdowns. Lower rates can make buying more attractive, but it’s essential to consider factors like inventory, home prices, and long-term financial goals when making a decision.

At Realtor Rick Las Vegas, we help buyers navigate the market and find the best opportunities, whether rates are low or the economy is shifting. If you’re considering buying a home, let's discuss your options and make the most of current market conditions!

Recent Posts

Realtor | License ID: S.0199279

9205 W Russell Rd, Suite 240, Vegas, NV, 89148, United States